I had a customer do a 40% prepayment for 6 items. We shipped 4 in April and will ship 2 in September. I did not see a way to allocate the prepayment proportionally–2/3 in April and 1/3 in September. The pre-payment allocated entirely to the April shipment. While the customer was understanding to my explanation of the invoice to them, it would be highly preferable to be able to split the prepayment between invoices. Is there a way to do that? If not, is that a feature that could be added?

@Greg,

What you’re describing is how this gets handled currently, if there’s a prepayment on the order then invoices against that order are going to consume the entire prepayment amount first. You can correct this on a case by case basis by reopening the automatic payment and adjusting the applied amount.

Is this type of situation how you handle all of your prepayments? Is there something unique about this customer, or a specific impetus for why you’d want to have break up the prepayment this way? Just want to better understand the situation, so we can determine if we do need to evaluate/update the prepayment behavior here.

The customer bought 2 different products on one purchase order. Line item 1 (Product #2) and Line Item 2 (product #14) on our Sales Order. Vastly different pricing, and delivery separated by nearly 6 months

I created a down-payment invoice off of line 1, invoice 350 for product #2–shipped in April.

I created a down-payment invoice off of line 2, invoice 351 for product #14–shipping in September.

When I go into these progress invoices (350 and 351), they correctly reference the product numbers and payment value.

When I shipped line item 1 in full, the system applied the downpayment for line item 1 and line item 2.

From a cash-flow perspective, not desired. From a GAAP perspective, not desired. From a process perspective, not desired to have to go in a manually adjust the invoices or the ledger after the fact.

if that is the expected behaviour, then that would drive me to create individual sales orders for each line item, which is administratively burdensome and confusing internally as well as confusing for the customer externally since they issued a single PO and most do not want to issue multiple POs since that imposes a burden on them and poses questions for GAAP/internal processes (since it may appear that they are trying to avoid internal $ limit based reviews by breaking up the PO into multiple POs).

Thanks for the response @Greg.

We’ll take this to our development team for review, and update you if we get any new information or have any follow up questions.

Hi @Greg !

Wanted to follow up with you here. At this point, we don’t have a way to split order prepayments to specific order/invoice lines. As you noted, the prepayment on an order automatically applies to the “next” invoice/shipment. For situations like this, you have two options.

One scenario is to create an unapplied cash amount separately from the order itself. Create an AR payment, but don’t associate them with any invoices. Just create it with the intention of applying that unapplied cash (money received on the AR payment) at the time of final shipping/invoicing of the line.

When it’s time to invoice the customer for shipment one, the unapplied cash is applied to the invoice. Your invoice pdf will then show the unapplied cash for that shipment.

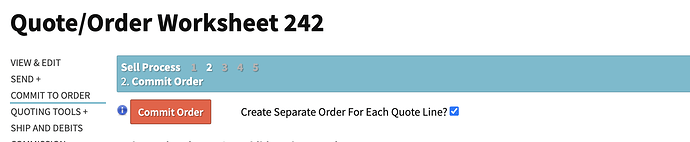

Scenario two is to split the quote lines to different orders (see the screenshot on the ‘commit to order’ screen)

This means your orders will be 242.1 and 242.2, but you can apply your prepayments to each order and they will automatically apply on each shipment.

Let us know if you have any questions here!

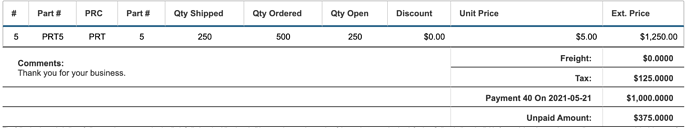

OK. i’ve done all that. Everything looks awesome on invoice 811.2 (shipped) and 812.3 (not yet shipped). I’ve got the progress payment 460 assigned and paid for 811.2; progress payment 461 towards 812.3.

I go to generate the PDF of 811.2 and the total shows as if 460 was not paid even when in the non-PDF view of the invoice {/invoice/462/view} shows the correct “Total balance remaining due”.

For example, Total bill 811.2 should be $482. Customer prepaid $191 on progress payment 460. Final invoice 811.2 should be $291. That all shows good in the {/invoice/462/view} . But when i go to generate a PDF of the invoice, the total balance due shows $482 and that is what my customers’ accountants are thinking they should have to pay. The customer is raising their arms since the correctly believe the invoice should show $291 as the outstanding balance and would expect that to be shown so they can comply with GAAP but that i am incorrectly billing them (which i am not).

Hi Greg!

I’m takign a look at yoururl.com/invoice/462/pdf and I’m seeing the breakdown of payment.

Total Before Progress: 482

Billed: 191

Payment: 290

Unpaid Amount: 0.00

Is that correct?