https://justicebearing.cetecerp.com/purchaseorder/6448/view

This vendor is not coded for tax - the PO was not either; yet the receipt is imbalanced to what the voucher should be at $1084.00

We are having serious issues - we cannot voucher incoming POs b/c adding tax to the voucher.

The vendors are not coded incorrectly, not new - nothing should be activating this.

Have 2 Vendor POs that are adding tax and also to the voucher - all others seem fine.

6687.1 and 6683.1

I apologize for the delay on this. I am going to escalate this internally to look into this to figure out what is going on here.

Thanks,

Cetec ERP Support

I haven’t been able to replicate this issue. Do you know if these POs were ever taxable? You can’t even add tax on the receiving screen unless the PO is marked taxable. Do you have any insight on how these POs were made and if anything was different? I’m getting information from our accounting team to get your current receipts fixed but wanted to try and figure out how this happened in the first place.

Thanks,

Cetec ERP Support

I heard back from our accounting team and here’s what they suggested.

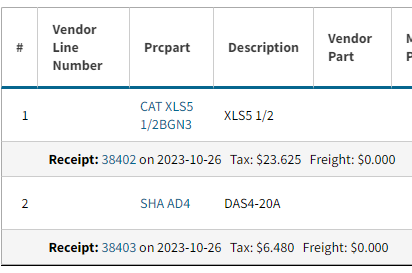

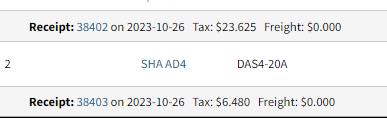

When line items were received, total dollars debited to Inventory and credited to Accrued was $1,157.17. When the vendor invoice was vouchered the values on the Ledger Splits were changed which then debited Accrued $1,084.00. The delta of $73.17 (the sales tax) is left in Accrued.

You made cost adjustments for the quantities that are still in inventory. There entries should debit a/c 211000 Accrued instead of a/c 421000 Materials:

Cetec ERP $23.625

Cetec ERP $ 6.48

For the balance of $43.06 ($73.17-$23.625-$6.48) make a manual ledger entry to debit 211000 Accrued and credit 421000 Materials.

Thanks,

Cetec ERP Support